Franchise Fundamentals: FDD Item 19

Item 19 Franchise Earnings Claims

Item 19 is where franchisors make earnings claims. These earnings claims are officially referred to as “financial performance representations” under the federal Franchise Rule.

Item 19 earnings claims can be derived from:

- actual historical financial performance, or

- potential financial performance.

The breadth and scope of each Item 19 contained in a franchise disclosure document (FDD) are limited only by the truth and a franchisors willingness and desire to make financial performance representations.

Earnings potential is often a top reason for purchasing a franchise opportunity.

What Qualifies As A Financial Performance Representation?

Under the federal rule, the term Financial Performance Representation is defined to include:

any representation, including any oral, written, or visual representation, to a prospective franchisee, including a representation in the general media, that states, expressly or by implication, a specific level or range of actual or potential sales, income, gross profits, or net profits. The term includes a chart, table, or mathematical calculation that shows possible results based on a combination of variables.

How Do Franchisors Obtain Item 19 Data?

Item 19 disclosures can be based on actual historical performance of certain outlets or may be based on a projection. However, the vast majority of Item 19 disclosures contain information on the actual historical performance of existing franchisees.

Historic data is typically compiled from the franchisors records, which may be accessed directly on a recurring basis or provided through monthly, quarterly, or annual reports. Typically, franchisees are contractually required to provide this information to the franchisor.

The financial information is generally unaudited, and the quality can depend in part on the systems and processes the franchisor has in place to track franchisee performance. In some models, this is easier than others.

What Can Be Included In Item 19?

Making an Item 19 representation is optional. Deciding whether to make any disclosure or determining the extent of a disclosure is largely within the discretion of an individual franchisor.

Generally speaking, a franchisor has two choices when it comes to Item 19:

- The Franchisor can elect not to make any financial performance representation and use specific language provided by the Franchise Rule to alert prospective franchisees that there are no representations; or

- The Franchisor can include a financial performance representation based upon the (a) actual historical financial performance or (b) potential financial performance.

If the franchisor makes any financial performance representation to prospective franchisees, the franchisor must have a reasonable basis and written substantiation for the representation at the time the representation is made and must state the representation in the Item 19 disclosure.

FDD Item 19 Examples

The breadth and scope of Item 19 disclosures varies widely. In our first example, the franchisor makes a broad disclosure, which includes the historical profit of certain locations. In the second example, the franchisor only discloses revenue, without regard to profit.

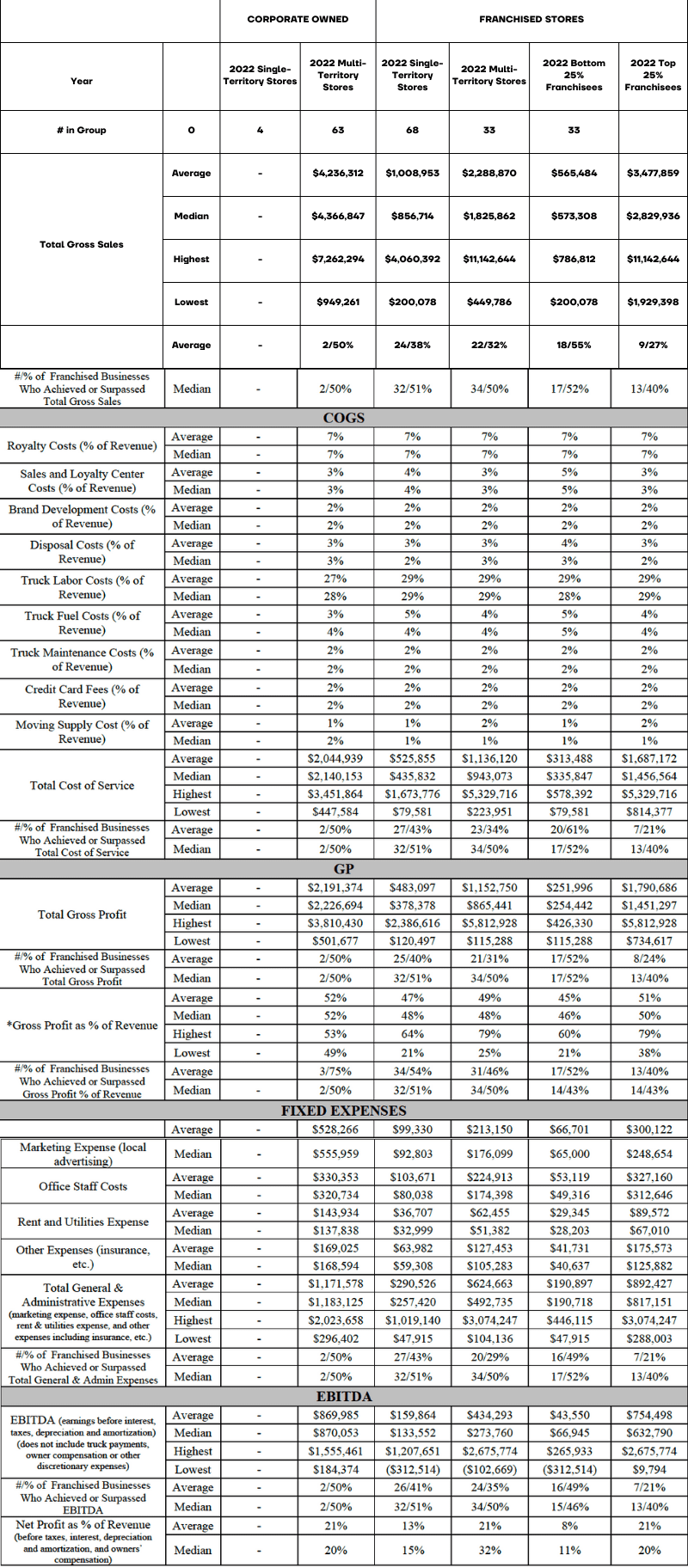

Detailed Item 19 with Gross Sales, Cost of Service, Gross Profit, Expenses, and EBITDA

The following is an example Item 19 from a publicly available FDD, which contains a thorough earnings claim. This represents a good example of what an Item 19 can contain.

There is a lot of information in this table; however, even more can be disclosed. For example, the below franchisor also disclosed performance metrics, ramp up periods, and per truck economics in separate tables contained in their FDD Item 19.

As you can see, a more through Item 19 makes it much easier for a franchisee to make an informed purchase decision. Although there is no guarantee that a franchisee will replicate these levels, it demonstrates transparency and potential.

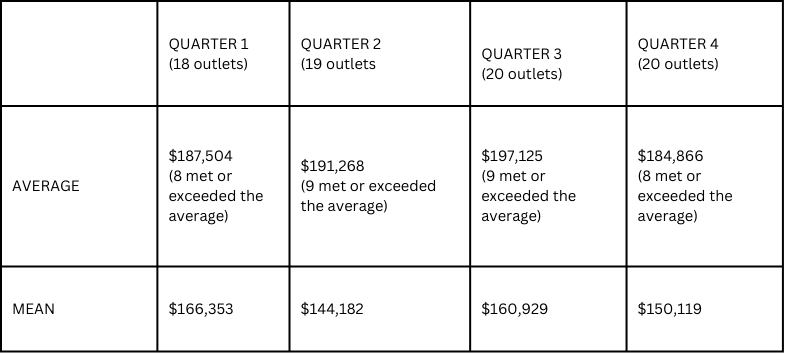

Basic Item 19 With Revenue Only

The above example is excellent from a transparency standpoint, but that type of disclosure is more of an exception than the norm. More often, franchisors will disclose revenue either on a monthly, quarterly, or annual basis without any indication of the cost of doing business.

What is Written Substantiation For An Earnings Claim?

If the franchisor makes an Item 19 FPR, then the rule requires the franchisor include a statement that written substantiation for the financial performance representation will be made available to the prospective franchisee upon reasonable request.

This means the franchisor must have, and present, data to back up their Item 19 claim.

Any prospective franchisee should ask the franchisor to present this back up data and every franchisor should be prepared to present it. The form of disclosure varies by franchisor and Item 19.