Considering a franchised Opportunity?

Franchising is an accelerated growth concept where business owners (“franchisors”) teach and permit other entrepreneurs (“franchisees”) to operate a business using the systems and processes developed by the franchisor. Purchasing a franchise can be an excellent strategy for new and seasoned entrepreneurs. Franchises are often considered a business in a box. The key for any entrepreneur is finding the right opportunity where the franchise concept and leadership team are aligned with their own passions, needs, goals, and objectives.

There are thousands of franchise concepts and finding the right one requires a hands-on approach. Thanks to federal and state regulations, along with the power of the internet, any entrepreneur can identify core candidates and learn a great deal of information about franchise offerings. The goal of this blog is to guide you through the process.

Identify Potential Franchisors

The first step is to identify the right industry. Of course, this will vary from person-to-person and will depend on experience, goals, and business structure. Some entrepreneurs will have experience in the space while others may simply see opportunity in a new space. Franchising is great because it can work for all types of entrepreneurs – from the owner operator to the corporate conglomerate.

Compile a list of franchisors

Once you identify the industry, you need to see who offers franchises in that space. Google is often a fantastic resource for this generic information. For instance, Google search for “list of dog grooming franchises”. A list of the top 10 dog grooming franchises in the United States will appear along with many ads and websites. Write them down! Identifying who franchises in this space is the first step.

Narrow the List

Leveraging the power of the internet can also help you narrow your list down to 3-5 contenders in the space. Some things to consider may be:

- Are customers excited about the franchised business, products, or services?

- Are there frequent customer complaints? If so, is this a franchisor or franchisee issue?

- What is the franchises presence and reputation in your geographical area?

- Is the franchisor an established brand or an up-and-coming brand?

- How are franchised locations being marketed?

- Do you like the brand image and brand messaging?

Determine if the Franchisor Can Sell Franchises in your State

Franchises are regulated by the federal Franchise Rule and by the laws and regulations in certain states. Some states require registration and review the FDD. Others have a less formal filing requirement. Franchisors do not necessarily offer franchises in every state. First, you need to determine if you reside in a franchise registration state. We list franchise requirements on a state-by-state basis here. If the franchisor is not approved to offer franchises in a particular state, they cannot offer a franchise until they are approved.

Research the Franchisor

Franchises can only be sold through disclosure of the Franchise Disclosure Document – often referred to as the FDD. The FDD is a legal document with business and legal terms about the franchisor and its leaders. Knowing how to locate an FDD and how to understand the information in the FDD can empower any entrepreneur to make an informed purchasing decision. Digesting legal duties and obligations often requires assistance of seasoned franchise legal counsel, but the disclosure documents themselves are often accessible online. Observing certain key areas before contacting a bunch of franchisors can help you save time and better narrow your focus.

Where to locate an FDD

Disclosure documents are public record on the NASAA electronic filing depository and in certain states. We recommend starting with NASAA because they serve as a depository for many participating states. Simply put, the are likely to have the FDD if the franchisor (or their attorney) utilizes electronic filing. If that doesn’t work, there are a few state databases.

Where to Look for Business Info in the FDD

The FDD is an excellent source of information, but it can be overwhelming. During the initial screening process, we recommend focusing on a few key areas for disclosure based on the profitability and growth of the company.

- Item 19: In this section of the FDD, franchisors can disclose financial information relating to the operation of corporate or franchised outlets. The information (or lack thereof) will vary by franchisor, but this often allows you to see if the franchisor has validated their model and the ability for franchisees to replicate a level of success. Item 19 can be a great way to differentiate different concepts based on the historic or projected performance of existing outlets.

- Item 20: In this section of the FDD, franchisors must disclose the status of company owned and franchised outlets over the past 3 years. This includes data on a state-by-state basis and displays information on new locations, transfers, terminations, and other exits. Analyze the growth trajectory and determine if it aligns with your goals and objectives.

There are 23 separate areas of disclosure required in each FDD. These are referred to as Item 1 through Item 23. Each Item covers a different topic area. You can learn more about what is required in the FDD here. Before making any purchasing decision, we strongly recommend you engage a franchise attorney who can analyze the FDD and offer legal support. Purchasing a franchise requires an understanding of the business components, along with an appreciation for the legal obligations.

Talk to Existing Franchisees

Existing franchisees can be one of the best sources of information. Item 20, or an attachment to Item 20, will include contact information for (1) all current franchisees and (2) all franchisees that left the system in the past 12 months. If you reach out to the franchisor, they will likely point you to certain high performers. However, a better practice is to reach out to as many franchisees as time permits. Its important to gain perspective from a range of franchisees. Franchisees can often provide details that cannot be included in an FDD. However, you should be aware that in some cases franchisors restrict what franchisees are permitted to say.

Work with a franchise attorney

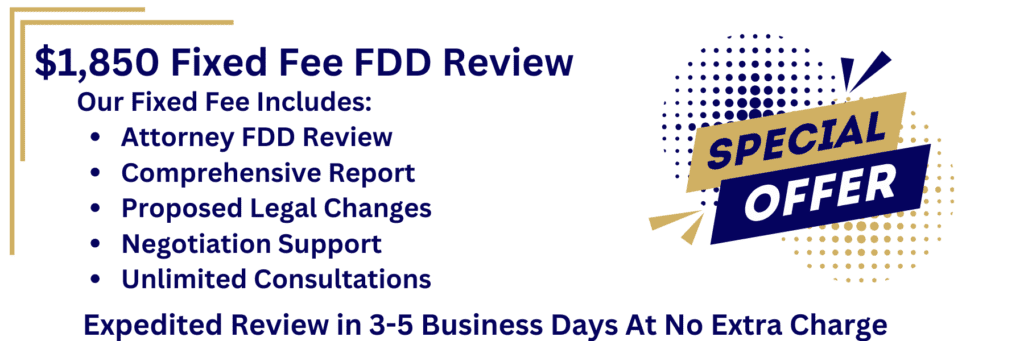

The typical franchise agreement requires a 5 to 20 year commitment. Its important to conduct business and legal due diligence before signing a franchise agreement. Working with a franchise law firm who represents franchisees can help you better understand the purpose of the franchise disclosure document and its contents. Many times, what is not present in the disclosure document is just as important as what is included. This knowledge often proves valuable, but appreciating the significance often requires the analysis of seasoned franchise counsel. Our law firm offers a competitive flat rate FDD review for franchise opportunties in Virginia and nationwide. Working with a franchise attorney can also help you understand any state level protections specific to franchise opportunities in your state. Federal franchise laws apply in every state, but certain states have passed their own franchise specific laws, rules and regulations.

Reviewing the FDD

Legal support often includes a comprehensive review of the FDD, generation of a report, unlimited consultation, and assistance on negotiating business and legal terms. Franchise law is a niche area of the law and many firms offer an FDD review for a fixed fee. When selecting franchise counsel, you should keep in mind that franchise law is a highly specialized area of the law.

Planning for Success

Entrepreneurs should establish a new business entity to sign the franchise agreement and operate the franchised business. This is an important part of risk management, and it is important to recognize that establishing an entity should not stop with its creation. Many business owners make the mistake of establishing an entity, but not following basic corporate formalities. This often occurs when an accountant or online provider offers to establish an entity, but cannot provide legal advice. Creating an entity without drafting operating documents and following basic corporate formalities is particularly detrimental when there are multiple business partners involved in a deal. Its important to work with legal counsel to plan for the good, the bad, and the ugly when establishing an entity and drafting its operating documents. Planning for success requires a collaboration between business and legal.

Meet the Author

Derek A. Colvin

Derek is a graduate of Penn State Law and Old Dominion University. He started his legal career in 2009 as a prosecuting attorney before entering private practice.

Derek currently serves business clients as a partner at Waldrop & Colvin, the law department for your business. His practice focuses on SMB client legal services and franchise law.

Derek is laser-focused on delivering efficient and effective solutions for business legal needs. As a seasoned litigator and experienced business attorney set on thinking critically and communicating effectively, Derek is well-suited to advise and protect your business.

Derek often serves as outside general counsel providing transactional support for business owners. He represents SMB independent owners, as well as franchisors, and franchisees as a franchise attorney.

Primary Practice Areas: Franchising | Franchise Law (Franchisor Legal Support & Franchisee Legal Support), SMB Mergers & Acquisitions, Entity Formation and Governance, Lease Negotiations, Trademark Registration, Dispute Resolution and Civil Litigation & Outside General Counsel Support